Persistent Decline in Copper Discoveries: What does it mean for investors?

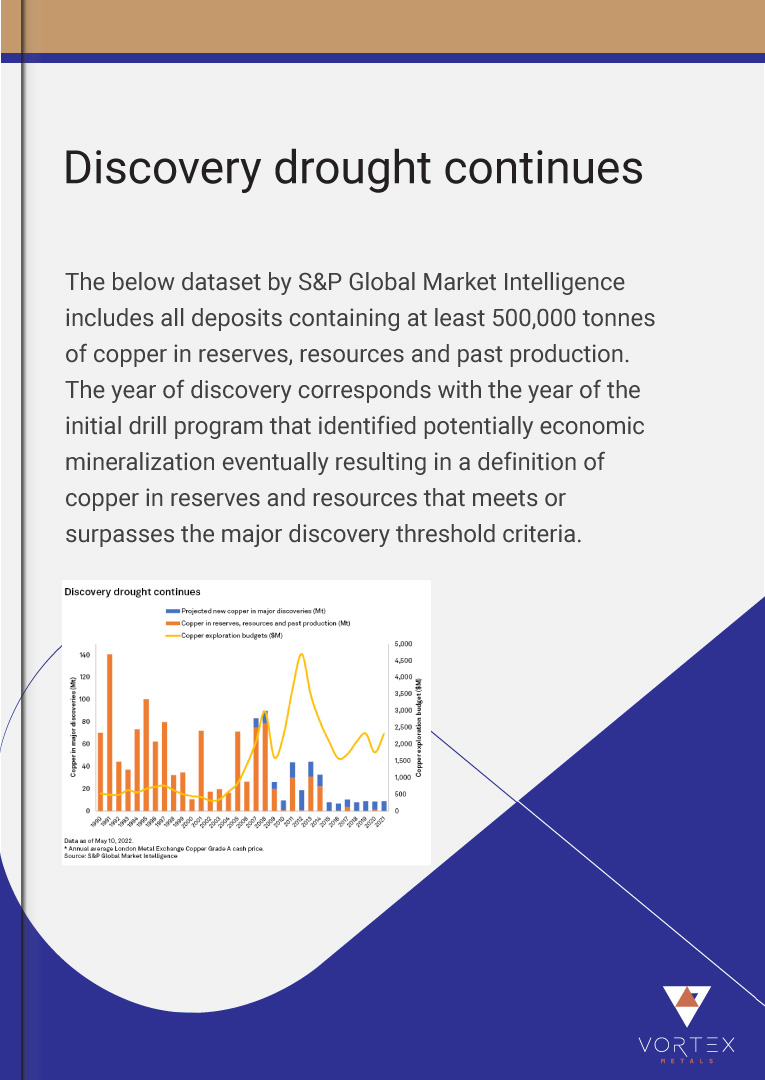

S&P Global’s annual analysis of major copper discoveries identified 228 copper deposits containing 1.18 billion tonnes of copper including reserves, resources and previous production between 1990 and 2021. Since the 2021 analysis, the total volume of discovered copper increased by over 50 million tonnes, but with majority coming from existing assets. In recent years, higher copper exploration budgets have not resulted in a significant increase in major discoveries – and with copper demand expected to outpace production, the industry is unable to support the long-term pipeline.

Download the research report now

Key takeaways from this report include:

Decreasing number of major new copper discoveries. Just 12 of 228 deposits were discovered in the past decade and contained only 60.5 Mt.

In the short term, strong copper demand is predicted to be met. However, in the medium-to-long term, copper demand will exceed production by 2025-26.

Latin America is the leading region for copper discoveries and will continue to be for the foreseeable future, attracting nearly 40% of annual exploration budgets over the past two decades.

648.7 Mt

Chile and Peru alone account for 78.3% of the 648.7 Mt discovered in Latin America and 43.2% of the global total found since 1990.

5.2%

Deposits discovered in the past decade contained only 5.2%, of all copper discovered since 1990.

143 Mt

It is predicted that the current decade will be the worst for copper discoveries since the data set began in 1990, with the projected amount of discovered copper to increase by under 143 Mt.